Nuclear power's "managerial disaster" still true 30-years later

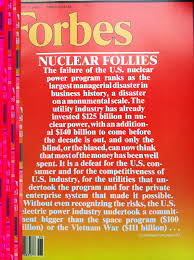

Forbes magazine’s February 11, 1985 cover story headlined “Nuclear Follies.” The business investment journal wrote “The failure of the U.S. nuclear power program ranks as the largest managerial disaster in business history, a disaster on a monumental scale… only the blind or the biased can now think that the money has been well spent.”

Forbes magazine’s February 11, 1985 cover story headlined “Nuclear Follies.” The business investment journal wrote “The failure of the U.S. nuclear power program ranks as the largest managerial disaster in business history, a disaster on a monumental scale… only the blind or the biased can now think that the money has been well spent.”

Fast forward thirty years, we see the nuclear industry still imploding. The “blind or biased” now include industry front groups like "Nuclear Matters" arguing that American taxpayers and ratepayers should still be bailing out the teetering industry at any cost. Ex-Environmental Protection Agency head Carol Browner and former New Hampshire Senator Judd Gregg were recently stumping in Northern Ohio on behalf of industry to keep the deteriorating nuclear power plant there from closing. However, their effort to spin the continued demise of dirty, dangerous and expensive nuclear power as a critical missed opportunity completely ignores the historic context that Forbes benchmarked decades ago for the business investment community. Nuclear power is fundamentally uneconomical. It has failed in the U.S. market economy and continues to fail worldwide.

Browner and Gregg’s snapshot of the remaining 99 U.S. reactors being down from 104 units needs to be put into an accurate historical context. In fact, the remaining 99 reactors are down from the 133 units originally licensed to commercially operate, which are down from 227 units that applied for construction permits and down again from 253 units ordered by the U.S. industry. This steady retreat is actually down from the 1,000 reactors that President Nixon’s “Project Independence” said would be operational by the year 2000.

In fact, what Browner, Gregg and their cohorts are suggesting is that the American people invest even more to prop up what Forbes then cautioned investors “is a defeat for the U.S. consumer and the competitiveness of U.S. industry, for the utilities that undertook the program and for the private enterprise system that made it possible.”

The nuclear industry is being priced out of the energy service market and at the same time becoming increasingly dangerous as a result of financial shortcuts and regulatory capture. The good news is that nuclear power is being replaced by rapidly growing solar and wind energy industries, energy efficiency and conservation. No surprise that Nuclear Matters, which is funded by the nuclear giant Exelon Corporation, would have the American consumers put the brakes on a 21st Century of affordable and renewable energy competition and instead stay the course with a rerun of Forbes’ 1985 warning.

February 11, 2015

February 11, 2015